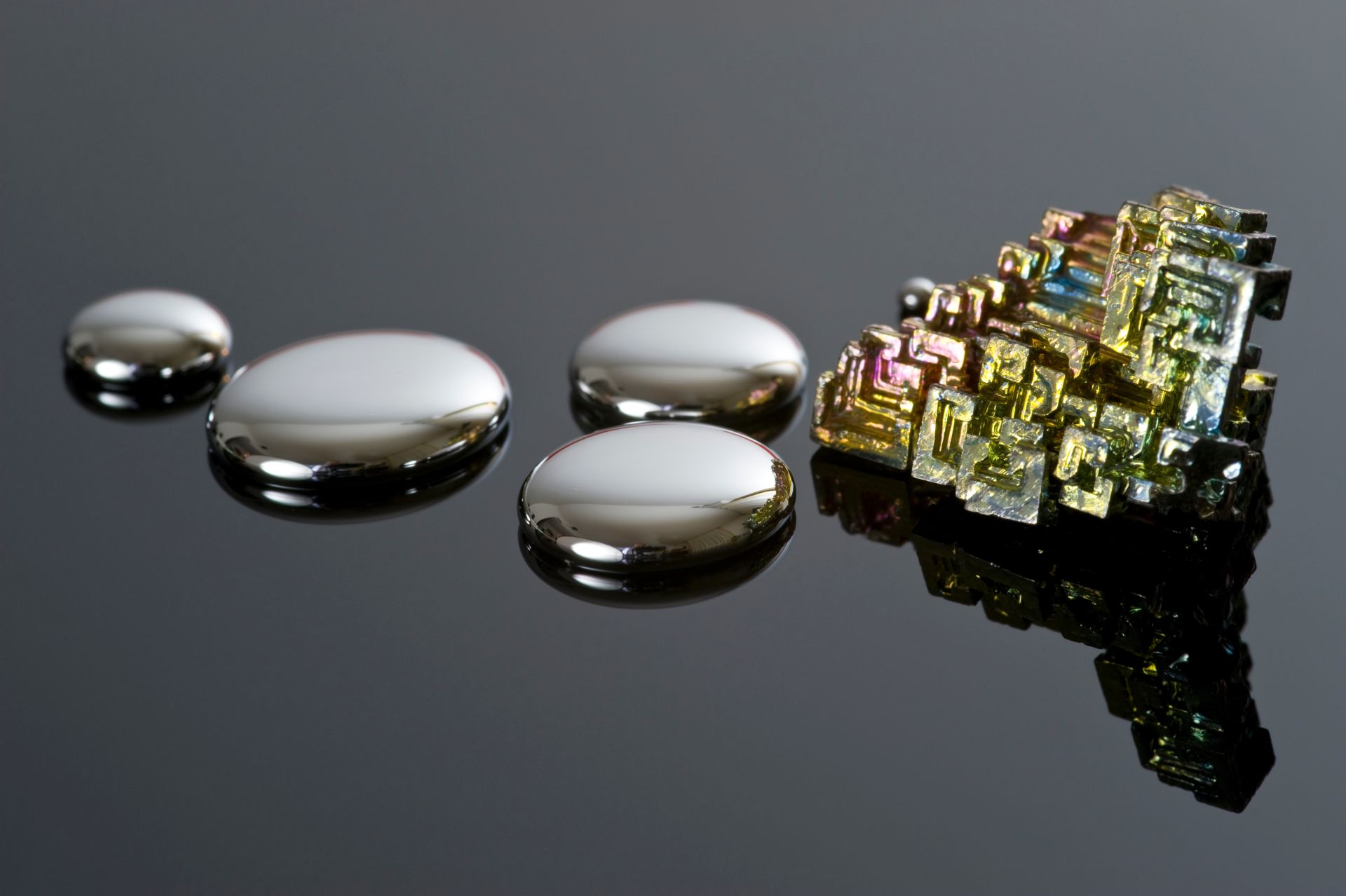

Bismuth is a unique specialty metal with a high density and low toxicity. It’s used in a broad range of applications, ranging from pharmaceuticals to atomic research. Manufacturers are increasingly turning to bismuth as a safer lead alternative in alloys, ammunition and food-processing equipment.

Globally, bismuth is primarily produced as a byproduct of metal processing. In this blog, we’ll explore how bismuth is refined and investigate how China’s export controls are affecting prices and availability.

How Bismuth Is Refined: From Byproduct to Commercial Metal

The majority of the world’s bismuth supply is recovered during the processing of lead, tungsten, copper, and tin. The ore is smelted to remove impurities, producing a crude metal that’s electrolyzed or chemically purified to commercial-grade standards. Bismuth is isolated from the byproducts using processes such as leaching, chlorination, precipitation, and electrolysis.

Most refined bismuth comes from lead ore. The specific process depends on the purity of the final product:

- Betterton-Kroll Process (low-purity lead). Molten lead bullion is treated with a calcium-magnesium mixture that alloys with bismuth. The alloy particles, which have a higher melting point, float to the surface as the lead cools. They form a dross that’s skimmed, melted, and treated with chlorine or lead chloride to separate other trace metals.

- Betts Electrolytic Process (high-purity lead). Lead bullion anodes and pure lead cathodes are immersed in a solution of fluosilicate and hydrofluosilicic acid. When electricity is applied, the anodes dissolve. Lead particles adhere to the cathodes; bismuth and other impurities fall to the bottom and form a slime. Bismuth is extracted from the slime metallurgical processes that vary based on the concentration.

Because bismuth is a byproduct, the global supply is inextricably linked with other metal industries. Production is constrained by external factors unrelated to demand, including geopolitical tensions and the output of primary metals.

China’s Dominance in Bismuth Production and Recent Export Restrictions

China controls 80% of the world’s refined bismuth supply. In recent years, Chinese export restrictions have had a significant impact on the global bismuth market. When the United States announced new tariffs in February 2025, China retaliated with expanded mineral export controls, including mandatory exporter licensing.

In the same month, Chinese bismuth exports declined by more than 40%. Prices surged to $40 in Europe and $55 in the United States.

The Global Impact: Supply Chain Disruptions and Pricing Pressure

As the U.S. escalates its trade war, China is poised to restrict bismuth supplies and drive prices even higher. In particular, supply chain disruptions could have an outsized effect in industries such as pharmaceuticals, cosmetics, electronics, and metallurgy.

Downstream companies are preparing for potential bismuth shortages as uncertainty increases. Some are seeking alternative suppliers in Laos, Japan, and Korea; others are stockpiling supplies in anticipation of longer procurement cycles. Researchers are developing bismuth alternatives, but the process could take years.

Understanding Bismuth’s Supply Risks in a Shifting Market

Bismuth is a critical mineral, but its global supply chain faces significant risks. The metal is a byproduct of refining, and the bulk of the world’s resources are controlled by a single country. As a result, China’s evolving export policies are likely to continue impacting price and availability in the coming years.

Belmont Metals offers high-quality bismuth solutions. Contact us to discuss your project needs.